Waiting. Sometimes a wise strategy, sometimes a foolish one. When it comes to home buying, waiting will surely cost you. There are a number of reasons why, but beforeI go into that, let’s get one thing clear…. if you aren’t in a positions to buy, if you truly can’t afford it, don’t do it. But if you are unsure, if you are “thinking about it”, if you are planning to “start looking” in a few months, you need to hop off the fence and start now. Waiting is a mistake. Here’s why:

Waiting. Sometimes a wise strategy, sometimes a foolish one. When it comes to home buying, waiting will surely cost you. There are a number of reasons why, but beforeI go into that, let’s get one thing clear…. if you aren’t in a positions to buy, if you truly can’t afford it, don’t do it. But if you are unsure, if you are “thinking about it”, if you are planning to “start looking” in a few months, you need to hop off the fence and start now. Waiting is a mistake. Here’s why:

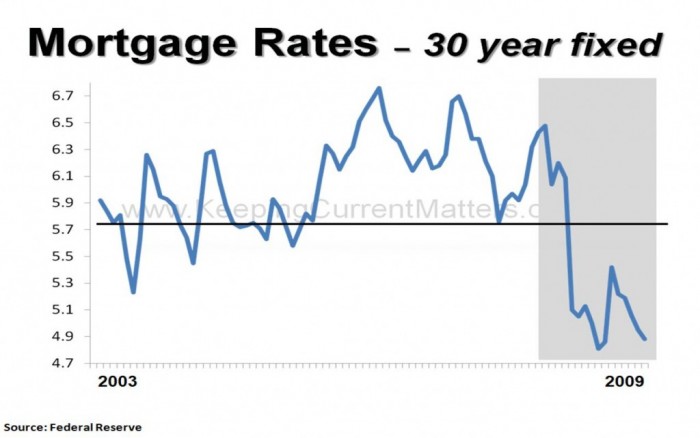

The biggest reason, more important than all of those reasons, is cost. When you look at the cost of home ownership, you need to look at total cost, the closings costs, mortgage payments, interest rate, all of it. Let’s look at interest rates, take a look at these charts created by Steve Harney at www.KeepingCurrentMatters.com.

Here we have a chart showing rates since 2003. Notice how low these rates are in the gray shaded area (about the last year)? These rates are being kept artificaially low by the goverment to help stimulate thereal estatemarket. The FED has already announced that they will back off of this position in the spring, so this will not last. Want further proof? Take a look at the next chart from Steve.

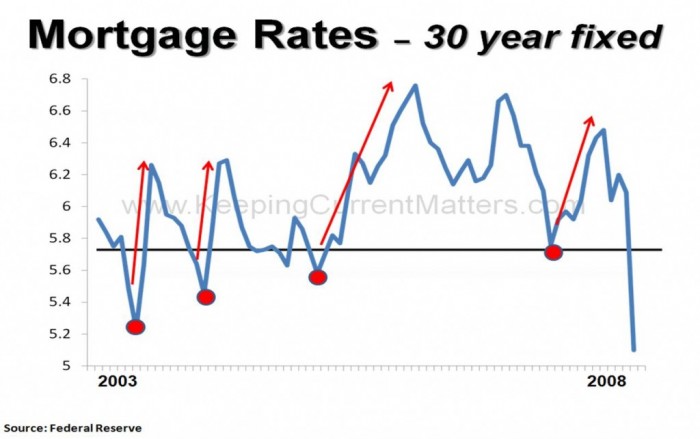

This chart shows the same interest rate data, from 2003 to 2008, but take a lookat those red dots.Theymark theonly times during that time period where the rates fell below 5.75%, only 4 times. Notice the red arrows? They show what happened next, rates shot up, as Steve says “quickly and dramatically”. Analysts are predicting that rates will be about 6% when the FED stops keeping them low. Now 6% isn’t that bad, but let’s have some fun with math and see what that does to your payments!

This chart shows the same interest rate data, from 2003 to 2008, but take a lookat those red dots.Theymark theonly times during that time period where the rates fell below 5.75%, only 4 times. Notice the red arrows? They show what happened next, rates shot up, as Steve says “quickly and dramatically”. Analysts are predicting that rates will be about 6% when the FED stops keeping them low. Now 6% isn’t that bad, but let’s have some fun with math and see what that does to your payments!

For the sake of easy math, let’s forget taxes and insurance, let’s just focus on principal and interest. If you were a buyer buying a Lancaster County Home for the current average sales price of about $185,000 (I know, technically, it’s a little lower in the latest numbers, but we’re keeping math simple, remember?), at today’s FHA rate of 4.875%, your P&I payment would be $979.04 per month. Not too bad.

So what about a higher rate? Let’s assume the analysts area little offand the FHA rate only goes up 1.0% to 5.875%. At thatinterest rate, if you were to buythat home it would costyou $1,094.34. That is $115.30 more per month out of your pocket, for the exact same house.What if you don’t have more? Most people pick home price ranges based on what their budget allows, so that’s aplausible thought process. So let’s sayyour bugdet only allows $979 per month, the number we had in the first example. That means you can only qualify for a $165.000 home at 5.875%.

So either way you lose. By waiting, you either lost $20,000 in purchasing power or you willpay $115 more per month. Now, most people who are waiting are doing so because they think maybe prices will come down. Let’s look at that thought process. Here in Lancaster County, the average home price fell from $190,533 last fall to $183,998 now. That is only3.4%. In 12 months.

We have 3.5 months from now until the end of March, when the rates are expected to rise (they may go up sooner, you never know!). Ifour average sales priceonly fell 3.4% in one of the toughest economic years we’ve had around here in decades, what do you think will happen in those 3.5 months? Maybe the average home price will fall another 1% or 2%? Heck, let’s be outrageous and sayit will fall another 3%! So if that happens, $183,998 – 3% = $178,478.06. That is a difference of $5,519. That is a far cry from the $20,000 in purchasing power you lose in this scenario and I would be willing to bet, go ahead, you name the terms, that we won’t lose another 3% in Lancaster in the next 3.5 months.

So if you wait, you miss out on the Tax Credits expiring April 30, you get higher interest rates, you lose purchasing power. None of this even begins to take in to account the possibility of increasingclosing costs,I wrote about how they might be going up last week, more on that as things happen.

I’m not trying to scare anyone.If you shouldn’t be buying, don’t buy. See Ben Franklin looking at you at the top of the post though? He’s there looking at youbecause he knows that if you plan on buying a home in the next 6 -12 months, waiting is a mistake. He’s waiting to see what you will do. Your friendBen ison the $100 bill and is certain of one thing, you will be seeing a lot lessof him if you wait.

I’d like you to be part of the conversation, so if you like what you read here please comment, forward The Lancaster Connection.com to your friends, subscribe and as always, if you have questions, need real estate advice or want to buy or sell a home, you can call or text me at 717-371-0557, email me at Jason@JasonsHomes.com or contact me at the office at 717-490-8999!

Your Friend in Real Estate,

Jason Burkholder

Weichert, Realtors – Engle & Hambright

Search for Lancaster County Homes for sale at www.JasonsHomes.com by clicking here!

Want to see what’s happening to home prices in your neighborhood? Go towww.RealEstateCrystalBall.com !