If you’re considering selling your house on your own as a “For Sale by Owner” (FSBO), you’ll want to consider a few factors. Going this route means shouldering a lot of responsibilities by yourself – and, if you’re not an expert, that opens the door for mistakes to happen and can quickly become overwhelming.

A report from the National Association of Realtors (NAR) shows two key areas where people who sold their own house struggled the most: pricing and paperwork.

Here are just a few of the ways an agent makes those tasks a whole lot easier.

Setting the right price for your house is important. And, if you’re selling your house on your own, two common issues can happen. You might ask for too much money (overpricing). Or you might not ask for enough (underpricing). Either can make it hard to sell your house. According to NerdWallet:

“When selling a home, first impressions matter. Your house’s market debut is your first chance to attract a buyer and it’s important to get the pricing right. If your home is overpriced, you run the risk of buyers not seeing the listing.

. . . But price your house too low and you could end up leaving some serious money on the table. A bargain-basement price could also turn some buyers away, as they may wonder if there are any underlying problems with the house.”

To avoid these problems, team up with us. We know how to figure out the right price because for your property in today’s market (not yesterday’s) because have a deep understanding of the local housing market. We use that expertise to set a price that will get you to the best price that buyers are willing to pay, giving your house the best chance to impress from the start.

Selling a house involves a bunch of paperwork and legal documentation that has to be just right. There are a lot of rules and regulations to follow (plus it all varies by state !), and that makes it a bit tricky for homeowners to manage everything on their own. Without a pro by your side, you could end up facing liability risks and legal complications.

We aren’t lawyers and can’t give legal advice, but we are experts in all the contracts and paperwork needed for selling a house. We know the rules and can guide you through it all, reducing the chance of mistakes that might lead to legal problems or delays. As an article from First American explains:

“To buy or sell a home you need to accurately complete a lot of forms, disclosures, and legal documents. A real estate agent ensures you cross every ‘t’ and dot every ‘i’ to help you avoid having a transaction fall through and/or prevent a costly mistake.”

So, instead of dealing with the growing pile of documents on your own, team up with us so we can be your advisor, helping you avoid any legal bumps in the road.

One of the biggest perks of using us as your listing agent isthe fact that we know how to leverage the tools available for the best result. We have access to the MLS, as do others. This is part of how we can instantly post your home to over 14,000 websites, including the big names you know. But really, “put it in the MLS” is one piece. Not all of it. How you use it, when, what info is there and when, all of it matters. Other agents also use the local MLS when searching for their buyer clients and will often set up saved searches. This means that once a home is listed that fits a buyer’s criteria, the buyer is immediately notified. So it has to be right from the start, or you miss out on them.

We use the latest metrics of buyer activity, open house attendance (yes, we do them, and they work), professional marketing materials and the right presentation to make your home attractive not just to all buyers, but to the ones looking for a place like yours.

Long story short, using us gives you massive exposure that isn’t possible as a FSBO. The more exposure your home gets, the more offers you receive. The more offers you receive…the more options you have. Those options will vary on price, closing timeline, requested repairs, and more. We’ll will help you pick the best offer for you! We’ll also walk you through every step- from listing to settlement.

Selling a house on your own can cost you a lot of time and stress. Let’s connect so you have help with all the finer details, including setting the right price, handling all the paperwork, and so much more. Give us a call or text at (717) 371-0557 !

Your Friends in Real Estate,

Jason Burkholder Team

——————

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

Ron Weaver

717-371-0557 direct or text

Hometown Property Sales Group, LLC

717-207-8093 office

57 E Main St

Lititz, PA 17543

Get ready for 10 days of ice sculptures, special menu items, family friendly fun, and a whole lot more in Downtown Lititz, PA ! Below is the full schedule! For the full event info, including food trucks, FAQs, a giveaway, and the sponsors who support the event, visit the Lititz site here!

We’re proud to sponsor the annual Hometown Fire Crawl, where Downtown Lititz shops create special dishes, drinks & samples for the Fire & Ice Festival ! Some examples include a creme brulee latte, hot cocoa cookies with some heat, hot sauce samples, handcrafted cocktails & more!

We hope to see you there !

Your Friends in Real Estate,

Jason Burkholder Team

——————

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

717-371-0557 direct or text

Hometown Property Sales Group, LLC

717-207-8093 office

57 E Main St

Lititz, PA 17543

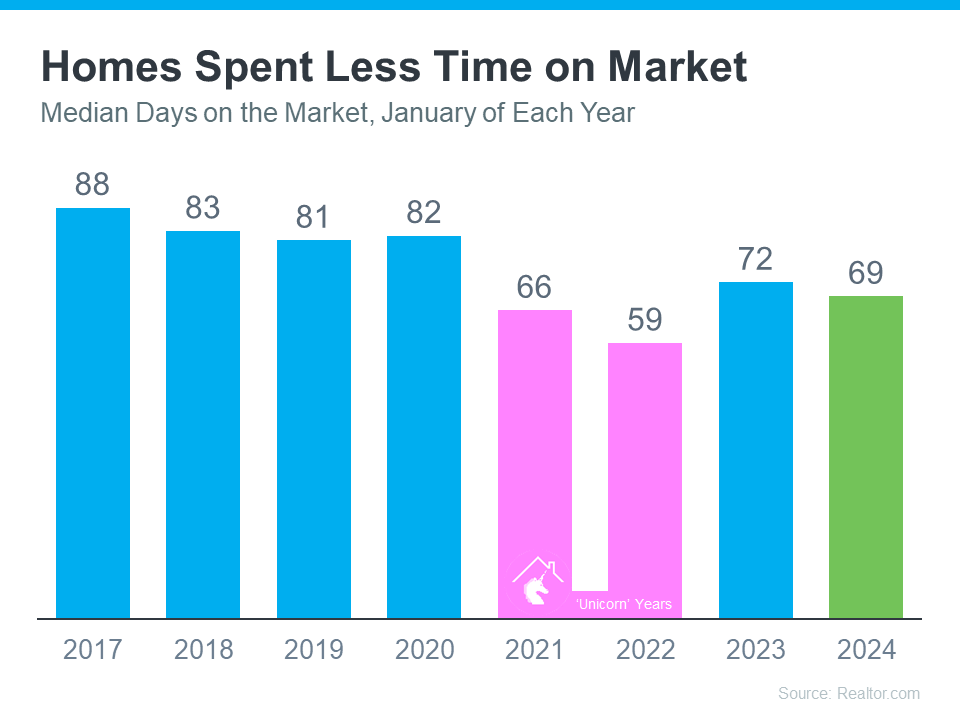

Have you been thinking about selling your house? If so, here’s some good news. While the housing market isn’t as frenzied as it was during the ‘unicorn’ years when houses were selling quicker than ever, they’re still selling faster than historically normal.

The graph below uses data from Realtor.com to tell the story of median days on the market for every January from 2017 all the way through the latest numbers available. For Realtor.com, days on the market means from the time a house is listed for sale until its closing date or the date it’s taken off the market. This metric can help give you an idea of just how quickly homes are selling compared to more normal years:

When you look at the most recent data (shown in green), it’s clear homes are selling faster than they usually would (shown in blue). In fact, the only years when houses sold even faster than they are right now were the abnormal ‘unicorn’ years (shown in pink). According to Realtor.com:

“Homes spent 69 days on the market, which is three days shorter than last year and more than two weeks shorter than before the COVID-19 pandemic.”

Homes are selling faster than the norm for this time of year – and your house may sell quickly too. That’s because more people are looking to buy now that mortgage rates have come down, but there still aren’t enough homes to go around. Mike Simonsen, Founder of Altos Research, says:

“. . . 2024 is starting stronger than last year. And demand is increasing each week.”

If you’re wondering if it’s a good time to sell your home, the most recent data suggests it is. The housing market appears to be stronger than it usually is at this time of year. To get the latest updates on what’s happening in our local market, let’s connect.

Ready to be in a new home for next holiday season? We can help! Give us a call or text at (717) 371-0557!

Your Friends in Real Estate,

Jason Burkholder Team

——————

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

717-371-0557 direct or text

Hometown Property Sales Group, LLC

717-207-8093 office

57 E Main St

Lititz, PA 17543

You’ve seen how gray has become the norm for new construction and renovated homes in the last decade. We’ve seen it in the form of paint, furniture, and decorations. Rip out the carpet, replace it with hardwood flooring, paint the walls gray, cabinets white, add a gray couch, and you’re done. They call this look “millennial gray”.

Why do they call it “millennial gray” when plenty of Gen X’rs and Boomers bathed their homes in gray? We don’t know, probably because they blame millennials for everything, but we can’t solve that problem here. Back to the gray. Or is it grey?

However you spell it, it has been everywhere. The perk of gray is it’s neutral. There’s a lot of versatility. Now, it’s coming to an end as tastes change (thank you everyone, gray is so played out it’s just now grayed out – Jason). People are ready for something different. It’s time to bring back some color to the world, are you ready for color and unique interior design? We are (well, Jason is)!

Why should you use colors?

How can you implement color ?

Of course, no amount of new paint will fix everything, so if you’re looking for a new space altogether, you know we can help! Give us a call or text at (717) 371-0557, let’s talk about where you want to go next!

Your Friends in Real Estate,

Jason Burkholder Team

——————

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

717-371-0557 direct or text

Hometown Property Sales Group, LLC

717-207-8093 office

57 E Main St

Lititz, PA 17543

Info & ideas pulled from this article written by Evelyn Long for NAR.

Hey friends, how many of you love getting junk mail? Would you like to find a way to get out of getting junk mail?

View this post on Instagram

It’s really actually easier than you think. The three credit reporting companies out there that keep track of everything you do, TransUnion, Equifax, and Experian, have lists that they sell on a regular basis to financial companies, credit cards, auto loan refinancers, insurance companies, you name it. Watch this video for an easy way to opt out and protect your privacy!

A huge majority of these solicitations you find in your mailbox come from the fact that the credit reporting companies sell you on a list. If you want to get off that list, you can go to this page on FTC.gov and fill out the information requested. Your junk mail is going to trickle down to next to nothing, not nothing, because, you know, of course it’s 2024, you’re going to get tons of junk mail, no matter what, you’re not going to stop robocalls or all spam emails, but you can stop the credit reporting companies from selling you on lists of people that just want to spam your mailbox with mail that you don’t want, you don’t need, and things you’re just going to throw away anyway. So, you want to get rid of the junk mail? Go to www.OptOutPrescreen.com or find the link on FTC.gov

After you’re done, feel free to go to the individual credit reporting companies, TransUnion, Equifax, and Experian, and see if they have additional opt out methods on their website. You might have to create an account, but go in there and turn off their ability to sell you. Just because they’re collecting your information doesn’t mean you have to allow them to profit off of it. I hope that helps, and if you ever have any questions that I can answer for you, feel free to give me a call.

Your Friends in Real Estate,

Jason Burkholder Team

——————

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

717-371-0557 direct or text

Hometown Property Sales Group, LLC

717-207-8093 office

57 E Main St

Lititz, PA 17543

As the holidays come to a close and you begin to “de-decorate,” here are a few ways to keep your decorations organized. Plan it out, be intentional, and your future self will thank you!

1. Tubs & labels- purchase clear tubs or heavy duty tubs like these to store everything. Having items “tucked away” keeps your storage area looking its best! Labels can be printed or handwritten onto masking/painter’s tape- just make sure you have the label on the side AND top of bin! Take it one step further and use an app like Sortly, which assigns you QR codes for each bin. Scan the code and you’ll be shown photos of that bin’s contents! (source)

2. Use cardboard for string lights– avoid tangles by wrapping string lights around cardboard! It’s the perfect way to use up empty gift boxes!

3. Hang wreaths- if you’re already using a closet to store decorations, you can use the existing rod to hang wreaths, or buy another rod to have a double decker closet ! That way your wreaths won’t get flattened in storage.

4. Accessibility- what decorations or materials are you reaching for first? Pack those away last so they’re easy to pull out next season!

5. Door organizer- maximize your storage space and have an over the door organizer for wrapping supplies! Stay organized and keep the supplies within arm’s reach for all gifting occasions!

6. Reuse tissue paper- save used tissue paper to wrap around fragile ornaments

7. Purchase a tree bag- keep your artificial tree clean & looking its best

8. Declutter- with all your decorations already out, now’s the time to decide what to keep, throw away, or donate!

Ready to be in a new home for next holiday season? We can help! Give us a call or text at (717) 371-0557!

Your Friends in Real Estate,

Jason Burkholder Team

——————

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

717-371-0557 direct or text

Hometown Property Sales Group, LLC

717-207-8093 office

57 E Main St

Lititz, PA 17543

You don’t have to knock out a wall or rip apart your kitchen to upgrade your living space. Small changes can make all the difference !

And of course, the ultimate home upgrade, buying a new place to start all over again is something we can always help you with!

Ready to make a move? We can help! Give us a call or text at (717) 371-0557!

Your Friends in Real Estate,

Jason Burkholder Team

——————

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

717-371-0557 direct or text

Hometown Property Sales Group, LLC

717-207-8093 office

57 E Main St

Lititz, PA 17543

The Jason Burkholder Team has affiliated with Hometown Property Sales Group, LLC! We’re thrilled to partner with Broker Jeff Bowman and his team at this independent real estate firm, where we offer depth of experience and a partnership like none other.

We plan on increasing our local community involvement, while helping sellers and buyers move forward with a commitment to making any market successful! This partnership also allows us to add an affiliation with Hometown Property Management Services, to bring you an even wider range of services.

We’re based in Lancaster and Lititz, we serve clients in Lancaster, Lebanon, Berks, York, and Dauphin counties, and we have relationships with a wide network of professional Realtors that are everywhere we aren’t. Our team is locally focused, with a regional reach and global connections to help you move anywhere you want to be.

Looking to sell or buy real estate? Call us at 717-371-0557!

Your Friends in Real Estate,

Jason Burkholder Team

——————

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

717-371-0557 direct or text

Hometown Property Sales Group, LLC

717-207-8093 office

57 E Main St

Lititz, PA 17543