There’s no doubt that owning a home comes with significant financial benefits. And this time of year is a great time to reflect on the other reasons why owning a home is so meaningful. Today, December 26, is National Homeowners Day and its the day some people think is the ideal day to put an offer on a home to get the best deal. Well, that’s debatable. For so many reasons, like the fact that all real estate is local. Hyper local in fact. What is happening in Nevada or Florida or even Philadelphia has very little effect on home sales in South Central PA.

But, the real reason why no day of the year is able to be the “best” day of the year to make an offer on a home is that the number one reason people buy a home is because …… they want to. Yup. They want to. Look at the graphic, with the exception of a hardship, all of those reasons are based on reasons that are personal, and revolve around what people want to do. And it makes sense, because a house is not just a thing.

A house is more than four walls and a roof – it’s home, a place where memories are made, connections are built, and life happens.

From the sense of accomplishment that comes with owning your own home to the joy of creating a space that’s uniquely yours, the emotional connections we have to our homes can be just as important as the financial ones.

Here are some of the things that turn a house into a happy home.

Buying a home is a significant milestone, whether it’s your first or your fifth. You’ve worked hard to make it happen and achieving this goal is a reason to celebrate. There’s nothing quite like stepping through the door of a home that’s yours and knowing you’ve accomplished something truly special.

Compared to renting, owning a home can give you a much greater sense of security and privacy. It’s your own place – not your landlord’s – and that just feels different and safer. No one else has the keys but you and that gives you your own personal safe place to retreat to at the end of a long day.

Owning a home means you have the freedom to personalize it however you like. While there can be HOA guidelines you may have to follow depending on where you buy, you can still make it a reflection of your style and create a space that feels just right for you. As Freddie Mac explains:

“As the homeowner, you have the freedom to adopt a pet, paint the walls any color you choose, renovate your kitchen, and more. You can customize your own space without approval from landlords.”

More Households in the U.S. have pets than children. Really, it’s true. According to recent data shared by the National Association of Realtors®, the share of U.S. households with children is 40%, compared to 70% of households that have a pet. It’s not that surprising really, because as a renter, you can only have a pet if your landlord allows it.

Multi-Generational home buying is an increasing trend. Have you heard of the “sandwich generation”? Most often Gen X, but also including older Millenials, the sandwich generation is adults helping to take care of parents while also taking care of kids. Maybe you’ve heard of grandparents moving in with kids to help provide childcare, or college graduates staying with parents for a few years before they launch to build financial stability. While not everyone wants these scenarios, multi generation households are a growing part of the housing market and there can be a lot of benefits. As always, thats a personal decision for you, unless of course you rent, and the landlord doesn’t want to allow another adult to move in.

Homeownership often means putting down roots in a neighborhood and becoming a part of the local community. According to groups like Habitat for Humanity, owning a home increases your interest in getting involved with your neighbors and local organizations. Whether it’s through joining a neighborhood group, volunteering, or simply getting to know the people next door, a home is a great foundation for building meaningful connections.

Owning a home is about so much more than financial benefits – it’s about the pride, well-being, control of your life and sense of belonging it can bring. If you have questions, or when you’re ready to take the next step toward buying a home, we’re here to help, call us at 717-371-0557.

Your Friends in Real Estate,

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

Ron Weaver

Jason Burkholder Team

Hometown Property Sales

717-207-8093 office

As you figure out who you’ll partner with, it’s important to know what to expect and what to look for. Unfortunately, there may be some myths holding you back from making the best decision possible. So, let’s take some time to address those, and make sure you have the information you need to find the right agent for you.

You might think all agents are the same – so it doesn’t matter who you work with. But, in reality, agents have varying levels of experience,specialties, and market knowledge, which can have a big impact on your results. For example: you’ll get much better service and advice from someone who is a true expert in their field. AsBusiness Insiderexplains:

“If you were planning to get your hair done for a special event, you’d want to visit a stylist who specifically has experience doing that type of work – you wouldn’t make an appointment with someone who primarily does kids’ hair. The same concept applies to finding a real estate agent. If you have a smaller budget, you probably don’t want to work with an agent who exclusively sells multimillion-dollar properties.”

Take some time to talk with each agent you’re considering. Ask about their experience level and what they specialize in. This will help you find the one that’s the best fit for your search.

As a seller, you may think you can save money by not working with a pro. However, the expertise,negotiationskills, andmarket knowledgean agent provides generally saves you money and helps you avoid making costlymistakes. Without that guidance, you could find yourself doing something likeoverpricingyour house. And that’s a misstep that’ll cost you when it sits on the market for far too long. That’s whyU.S. News Real Estatesays:

“When it comes to buying or selling your home, hiring a professional to guide you through the process can save you money and headaches.It pays to have someone on your side who’s well-versed in the nuances of the market and can help ensure you get the best possible deal.”

You may also be worried an agent will push you to buy a more expensive house in order to increase their commission. But that’s not how that should go. A good agent will respectyour budgetand work hard to find a home that truly fits your financial situation and needs. With their market know-how, they’ll point you toward thebest optionfor you, rather than try to pad their own pockets on your dime. AsNerdWalletexplains:

“Among other things, a good buyer’s agent will find homes for sale. A buyer’s agent willhelp you understand the type of home you can afford in the current market, find listed homes that match your needs and price range,and then help you narrow the options to the properties worth considering.”

Maybe you believe housing market conditions are the same no matter where you are. But that couldn’t be further from the truth. Real estate markets are highlylocalized, and conditions can vary widely from one area to another. This is why you can’t pick just anyone you find online. You should choose an agent who’s an expert on your specific local market. As a recent article fromBankratesays:

“Real estate is very localized, and you want someone who’s extremely knowledgeable about the market in your specific area.”

You’ll know you’ve found the right person when they can explain the national trends and how your area stacks up too. That way you’re guaranteed to get the full picture when you ask:“how’s the market?”

Don’t let myths keep you from the expert guidance you deserve. With market knowledge and top resources, a trusted local real estate agent isn’t just helpful, they’re invaluable.

In what could be one of the biggest financial decisions of your life, having the right pro by your side is a game changer. Let’s connect and make sure you get the best outcome possible. We know what we’re experts at, and where we’re experts, and also where we aren’t.

We are small, local and independent on purpose, and for a purpose. Helping people do what’s right for them. Call us at 717-371-0557

Your Friends in Real Estate,

Jason Burkholder Team

Hometown Property Sales

——————————-

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

Ron Weaver

717-371-0557 – cell

717-207-9083 – office

When you’re thinking about buying a home, your credit score is one of the biggest pieces of the puzzle. Well. Equally as big as your income at least. Think of it like your financial report card that lenders look at when trying to figure out if you qualify, and which home loan will work best for you. As the Mortgage Report says:

“Good credit scores communicate to lenders that you have a track record for properly managing your debts. For this reason, the higher your score, the better your chances of qualifying for a mortgage.”

It is likely none of that is surprising to you. The trouble is most buyers jsut don’t know, or understand, how credit scoring works and sometimes think they need a score much higher than the minimum credit score a lender is looking for to approve them to buy a home. According to a report from Fannie Mae, only 32% of consumers have a good idea of what lenders require. That means nearly 2 out of every 3 people don’t.

So, here’s a general ballpark to give you a rough idea. Experian says:

“The minimum credit score needed to buy a house can range from 500 to 700, but will ultimately depend on the type of mortgage loan you’re applying for and your lender. Most lenders require a minimum credit score of 620 to buy a house with a conventional mortgage.”

Most. Some. Those words don’t give you a lot of certainty, so basically, it varies. You need a good score to get a good interest rate, but even if your credit isn’t perfect, there are still options out there. As FICO explains:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders, and there are many additional factors that lenders may use . . .”

And realistically, even though “they” say the “minimum score could be as low as 500, that is not really true or a good thing. Sure, some lenders may go that low but you will pay a ridiculously high interest rate, and some stupidly high fees. Just no. Realistically, you have to be 600/620 or higher, or you don’t have a chance. Your approval odds for good lending terms are way better at 640 or higher, preferably 680 plus. Pretend 640 is the floor, the low point, under it is not going to give you great lending rates.

So if your credit score needs a little TLC, don’t worry, we can connect you with a lender and find out where you are, then help you create a plan to get where you need to go. In the meantime, Experian says there are some easy steps you can take to give it a boost, including:

Easy to say, sometimes hard to do, but let’s be honest. We like to be positive, but ya gotta accept reality too. You know if you’re on time or not. If you are paying your bills late, you won’t get approved for a mortgage until you are caught up and have a history of on time payments for a few months. Lenders want to see that you can reliably pay your bills on time. This includes everything from credit cards to utilities and cell phone bills. Consistent, on-time payments show you’re a responsible borrower.

Paying down what you owe can help lower your overall debt and make you less of a risk to lenders. Plus, it improves your credit utilization ratio (how much credit you’re using compared to your total limit). A lower credit utilization ratio means you’re more reliable to lenders, as a general rule. BUT, let’s talk before you start paying down the debt, as there are some strategic ways to maximize the results. Those utilization rates are more important than total debt or balances. Student loans for example, let’s say you have $45,000 in student loan debt and a payment of $300 per month. The lenders don’t really care about the total, they count the $300 per month.

While it might be tempting to open more credit cards to build your score, it’s best to hold off. New credit applications lead to hard inquiries on your report, which will temporarily lower your score. Don’t apply for that store card to get 5% off your purchase today, that is many times more damaging than you think.

Your credit score is crucial when buying a home. But even if your score isn’t perfect, there are still pathways to homeownership.

Working with us so we can connect you to a trusted lender is the best way to get more information on how your credit score could factor into your home loan.

Call us at 717-371-0557, lets get together and we can help you understand it all so you know exactly where you are, and can plan to get where you need to go. When you’re ready.

Your Friends in Real Estate,

Jason Burkholder Team

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

Ron Weaver

Hometown Property Sales

717-207-9083 – office

You may be confused. You may be wondering. You may be unsure. But you know. You know right now whether or not you want to move. You know right now what you need and if selling or buying a home is what you want to do.

So move. Sell your house, buy another, just do, or do not, right?

We know it’s not that simple. Moving is not just a big deal, it’s your life, it’s a huge deal. So what’s stopping you, one of the reasons here in this list?

Number 4 there makes a lot of sense if you’re confused or unsure of your path, because the real estate market can be confusing. A lot of people have found the most confusing part is knowing when and worry whatever they do, it’s not the right “time” to do it because of all the conflicting information out there. They’re trying to “time the market”; they’re trying to see what the future might be, listening to all the noise and media chatter, guessing whether interest rates go down (or up), if home prices go up or down, will more homes be available!?!

And then, even though they want to move they find themselves trapped in indecision. It’s no wonder most people are confused, the endless barrage of headlines contradict themselves hour to hour and there’s always someone with an opinion different than the last one you saw. The media confuses you on purpose. All those headlines and predictions drive ad revenue. They’re just guesses. Some of them are educated, some of them are not. Some are people who look good on social media and sound convincing. Some like to sound provocative. Some will be right. Most of them are wrong.

We heard a little green guy** say something like the future is always in motion, and we have found, that’s why the internet and news media is just almost always wrong in their predictions.

Forget them. Hop off the internet and turn off your tv. We can help you get past all of that noise because we know what we know and we are not confused. We do this every day, for a living. We don’t get paid to comment online or get ad revenue by creating fear, which we heard is the path to the dark side. We get paid by helping people buy and sell homes, right here in South Central PA.

We focus on the areas we know, we focus on what is happening now, we know the history here and we tune out what’s happening in another state, because it does not matter here, to you. We know the facts, trends and numbers you need, and we know how to explain them to you so you can understand them.

We are not confused because every single person we have ever helped sell or buy real estate did it for the same reasons you are considering. It was because they wanted to or needed to. There’s literally never been one who did it because the headlines told them to, or because the interest rate were perfect or the latest jobs report convinced them.

They moved because no matter what the headlines said, it was the right time for them. Or they didn’t because it wasn’t the right time for their life. They knew. Just like you know. So, be confident, we will get you past the confusion so you can decide to do, or do not.

Now that you read this far, let’s talk about #2 and #3 up there. Those are literally just logistics. We know how to help you buy and sell at the same time, fix credit, tap into first time buyer programs, how to know which lender to choose (and why), how to help you overcome all the logistical hurdles involved in getting where you need to go, and how to do the math needed to know what makes financial sense for you. We’ll show you the way forward. Then again, you decide do, or do not.

We are confident in our ability to help you clearly decide because when 900 years old you reach… ok, we aren’t that old. But we do have a couple decades of experience and have helped hundreds of people through the good times and the bad. Don’t worry about interest rates or headlines or financial reports. Call us at 717-371-0557, lets get together and we can help you understand it all so you feel comfortable making your move. When you’re ready.

Your Friends in Real Estate,

Jason Burkholder Team

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

Ron Weaver

Hometown Property Sales

717-207-9083 – office

**Back to the little green guy, we don’t want to violate anyone’s copyright and wouldn’t want to make any unfair comparisons, but Jason isn’t exactly tall (none of us are), and even if he doesn’t know the answer; he’s well connected to the real estate galaxy and knows another little green guy who does. So call us anytime and if we don’t service the area you want to move to, or don’t know the answer: we definitely have the connection to someone who does

Don’t get me wrong, I love new agents, I was new once too and have spent a couple decades training them. I love all the fresh perspective and new things I can learn from them. I don’t have a TikTok account but probably should get one before I get even more “too old for that ” 😆

Don’t get me wrong, I love new agents, I was new once too and have spent a couple decades training them. I love all the fresh perspective and new things I can learn from them. I don’t have a TikTok account but probably should get one before I get even more “too old for that ” 😆

In a world full of apps and AI on every smart phone that can make anyone look good (even giving me back some hair), and give the appearance of skill, appearance isn’t actually a substitute for learned skill and actual experience.

Technology is amazing, but not every problem is a nail to hit with a hammer. We like to employ the right types of technology for the right types of situations when it helps, and leave it in the toolbox when it doesn’t. Example? Ya can’t only text. Sometimes you have actually talk on the phone with someone and will find having a 2 minute long phone conversation can save hours of text misunderstanding. It’s just reality.

Video is another example of a useful tool that is light years ahead of even last year and excellent for building a brand online instead of being critical to selling a home. Different markets require different tools. I was doing video tours with a handheld video camera and uploading them into YouTube to send links to people across the country for virtual tours in 2010. I was doing video walk throughs and putting them on stand alone domains for 24/7 Open Houses starting back then too. Video helped me sell a lot of homes over the years. Then I stopped doing it after the market accelerated to where it is in 2021 and it was not needed. Things moved fast, we moved fast with them and well, I didn’t put the effort into “content creating”.

Our team framework will allow us to put the time into creating video without our client services paying the price. We’ll build a content library full of useful context and accurate information, as video has evolved from being needed to sell a particular home to what people turn to for education. I mean, we’ll show you cool houses too, but we won’t only show you those. We’ll get a new microphone first probably, as that tech evolved quite a bit and the one we have isn’t the best anymore.

The Olympics have shown us again what we already knew. Calm, level headed, learned experience is the difference maker. It allows us to know exactly what to do and when.

We know there is no one size fits all approach because everybody’s needs are different. While we love video, and we love energy and enthusiasm, there is a LOT of video online put out by creators who are enthusiastically and energetically wrong. Especially the video created by “influencers” who are making money off social media, not actually selling houses. Maybe they aren’t wrong, but what they are saying is just not realistic or practical or attainable for you in this market or in your area. Reality is what it is, not what we wish it was.

So we’ll be using video to help you know how to separate fact (there isn’t going to be market crash) from fiction (the sky is falling!?!?) and ensure that you have the information you need to be comfortable making your decisions.

We’ll get back into video soon (stay tuned!), and we’ll keep focusing on doing what we do best, using our experience to calmly guide sellers and buyers through the flashy noise and into their next home. – Jason

Looking to sell or buy real estate in South Central Pa? We’re here when you’re ready! Call us at 717-371-0557

Your Friends in Real Estate,

Jason Burkholder Team

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

Ron Weaver

#jasonburkholderteam

#jasonburkholderrealtor

#localprops #hometownprops

#hometownlititz #hometownpsg

#realestate #realtor #home #sell #buy

#realestatelife

#parealtor #lancasterparealtor

717-371-0557 direct or text

Hometown Property Sales Group, LLC

717-207-8093 office

There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to show you why that isn’t going to happen.

Accordingto Jacob Channel, Senior Economist atLendingTree, the economy’s pretty strong:

“At least right now, the fundamentals of the economy, despite some hiccups, are doing pretty good. While things are far from perfect,the economy is probably doing better than people want to give it credit for.”

That might be why arecent surveyfrom theWall Street Journalshows only 39% of economists think there’ll be a recession in the next year. That’s way down from 61% projecting a recession just one year ago (see graph below):

Most experts believe there won’t be a recession in the next 12 months. One reason why is the current unemployment rate. Let’s compare where we are now with historical data fromMacrotrends, theBureau of Labor Statistics(BLS), andTrading Economics. When we do, it’s clear the unemployment rate today is still very low (see graph below):

The orange bar shows the average unemployment rate since 1948 is about 5.7%. The red bar shows that right after the financial crisis in 2008, when the housing market crashed, the unemployment rate was up to 8.3%. Both of those numbers are much larger than the unemployment rate this January (shown in blue).

But will the unemployment rate go up? To answer that, look at the graph below. It uses data from that sameWall Street Journalsurveyto show what the experts are projecting for unemployment over the next three years compared to the long-term average (see graph below):

As you can see, economists don’t expect the unemployment rate to even come close to the long-term average over the next three years – much less the 8.3% we saw when the market last crashed.

Still, if these projections are correct, there will be people who lose their jobs next year. Anytime someone’s out of work, that’s a tough situation, not just for the individual, but also for their friends and loved ones. But the big question is: will enough people lose their jobs to create a flood of foreclosures that could crash the housing market?

Looking ahead, projections show the unemployment rate will likely stay below the 75-year average. That means you shouldn’t expect a wave of foreclosures that would impact the housing market in a big way.

You can see in this chart below, the level of active homes for sale is fairly stable, across all price ranges. New listings enter the market each day.

The buyer demand for the listings shows in the pending sales chart here, the lines are pretty close. Homes come on the market, and they sell fast.

There won’t be a wave of homes for sale that outpaces demand. Most experts now think we won’t have a recession in the next year. They also don’t expect a big jump in the unemployment rate. That means you don’t need to fear a flood of foreclosures that would cause the housing market to crash. The last crash is reflected in the chart below and shows you what happened to home values nationwide. While the numbers dipped, it was not for long, and they bounced right back. Not only will there not be a housing market crash, but even if we’re wrong, appreciation will bring values right back and then continue at a much more normal pace, as it has in the past.

Supply and demand remain balanced, so what you can expect for 2024 is pretty much what you saw in the last two years. We helped a lot of people find success buying, and selling, in these last few years, just like we did in the years before then. Don’t bother waiting to try and “time the market”, lets talk about what you want, then we’ll help you decide if now is the time for you. Will you compete as a buyer? Yes. Will you find lots of buyers wanting your home when you sell? Yes. No matter what you want to do, opportunity is there for you.

When you’re ready to talk, we’ll be here. Give us a call or text at (717) 371-0557!

Your Friends in Real Estate,

Jason Burkholder Team

––––––

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

717-371-0557 direct or text

Hometown Property Sales Group, LLC

717-207-8093 office

57 E Main St

Lititz, PA 17543

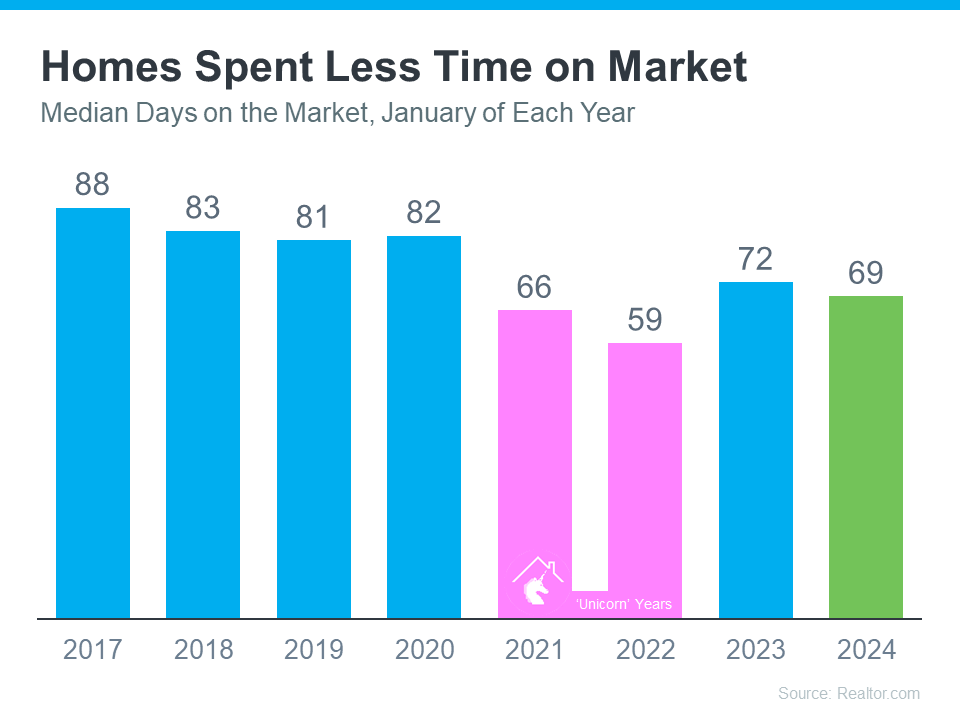

Have you been thinking about selling your house? If so, here’s some good news. While the housing market isn’t as frenzied as it was during the ‘unicorn’ years when houses were selling quicker than ever, they’re still selling faster than historically normal.

The graph below uses data from Realtor.com to tell the story of median days on the market for every January from 2017 all the way through the latest numbers available. For Realtor.com, days on the market means from the time a house is listed for sale until its closing date or the date it’s taken off the market. This metric can help give you an idea of just how quickly homes are selling compared to more normal years:

When you look at the most recent data (shown in green), it’s clear homes are selling faster than they usually would (shown in blue). In fact, the only years when houses sold even faster than they are right now were the abnormal ‘unicorn’ years (shown in pink). According to Realtor.com:

“Homes spent 69 days on the market, which is three days shorter than last year and more than two weeks shorter than before the COVID-19 pandemic.”

Homes are selling faster than the norm for this time of year – and your house may sell quickly too. That’s because more people are looking to buy now that mortgage rates have come down, but there still aren’t enough homes to go around. Mike Simonsen, Founder of Altos Research, says:

“. . . 2024 is starting stronger than last year. And demand is increasing each week.”

If you’re wondering if it’s a good time to sell your home, the most recent data suggests it is. The housing market appears to be stronger than it usually is at this time of year. To get the latest updates on what’s happening in our local market, let’s connect.

Ready to be in a new home for next holiday season? We can help! Give us a call or text at (717) 371-0557!

Your Friends in Real Estate,

Jason Burkholder Team

——————

Jason Burkholder

Kelly Burkholder

Jaci Hoosier

717-371-0557 direct or text

Hometown Property Sales Group, LLC

717-207-8093 office

57 E Main St

Lititz, PA 17543

Photo by æ„šæ¨æ··æ ª cdd20 on Unsplash

“Scary times don’t call for fearless leaders. We don’t need a gladiator jumping into an arena with the hungry tiger. Instead, times of fear and uncertainty call for leaders to become fear(less) – aware of and consciously able to sort through what is truly scary and deserves careful consideration and what is causing undue stress and anxiety without being a real threat.”

That quote came out of a quick article I read, here in this link . For the sake of this discussion, replace the word “leaders” with people. After all, leaders are just people, individual persons. You are also a person.

What does this have to do with real estate? Well, if I’m being philosophical, real estate is about people’s lives. A person can’t live their life in a constant state of fear, and really, there is no hungry tiger to defeat in this story, it’s real estate. What’s there to defeat? What is there even to fear?

If you care about real estate, the enemy is misinformation, uncertainty and the fear it drives.

It makes you question everything, and end up doing nothing. It’s not enough for me to say “be fear(less)” if you’re jumping into this real estate market. You have to actually be able to fear less things. Your ability to be “aware of and consciously able to sort through what is truly scary and deserves careful consideration and what is causing undue stress and anxiety without being a real threat” is important when you’re thinking about making a purchase or sale that will change your life and cost hundreds of thousands of dollars.

See, if you’ve been on the internet, or listen to the radio, or watch tv, you find pretty quickly we live in a world full of threats, real and imaginary. Fear. BE AFRAID. But mostly, the fear is imaginary. Clickbait. Lots of somebody’s hot take bullshit out there masquerading as news so you click and share. Sorry for the language, but it’s true.

Not only are we bombarded by headlines full of fear, but most of them are full of misinformation, missing pieces, things that are flat out incorrect analysis and bullshit. Take these statements for example:

Fear, sensationalism and wrong information in each bullet point. Why do I say that? Because we don’t write headlines, we sell real estate. We actually are working in the market every day, with buyers buying and sellers selling, not writing clickbait for ad revenue. Here’s the answer to each of those bullet points.

That’s the best part of working with us. You don’t have to figure out what’s true, and what’s not, in the headlines. There isn’t anything to be afraid of. You’re either wanting to buy a property or you aren’t. You’re either wanting to sell a property or you aren’t. If you are thinking about jumping into this, selling or buying, we can help you.

We know how to look at it all critically, and we’ll help you make sense of it. We have sellers selling each week with multiple offers over list price. We also have buyers winning multiple offer situations, buyers getting contracts signed with the ability to do home inspections, buyers getting contracts signed with offers that include seller help with closing costs, and buyer’s buying homes for list price or less.

We are not confused, we are not afraid and we’re ready to help you too. Call us at 717-371-0557, let’s talk! – Jason

Your Friends in Real Estate,

Jason Burkholder Real Estate Team

Jason Burkholder

Kelly Burkholder

Adam High

Jaci Hoosier

Welcome Home Real Estate

717-298-8040 office

57 E Main St

Lititz, Pa 17543

Ok friends, let’s shine the light on a couple myths floating around out there regarding the real estate market right now. There’s no denying that it’s a different market, and sometimes conflicting signals. But that’s kinda the case every year, and misconceptions floating around about this market, coupled with people filling airtime trying to “predict” what’s going to happen next aren’t making things any easier.

So what, exactly, are those misconceptions, and why are they incorrect? Let’s discuss some of the common myths in today’s housing market that are hurting both buyers and sellers, including:

So, what does it all mean for you? Exactly what we have been saying. Now is a good a time to buy, or sell, as any. People move because they want to, or need to, and despite headlines to the contrary, yes you can buy. We are helping people do it all the time. We can help you too. Let’s talk about it.

Looking to sell or buy anywhere in Central Pa? Call 717-371-0557!

Your Friends in Real Estate,

Jason Burkholder Real Estate Team

Jason Burkholder

Kelly Burkholder

Adam High

Jaci Hoosier

———————-

Jason Burkholder

AB066232

717-371-0557 direct or text

Associate Broker

Realtor, e-Pro, RENE, AHWD

Certified Marketing Specialist

C2EX Endorsed, Certified Ally

Jason Burkholder Real Estate Team

Welcome Home Real Estate

717-298-8040 office

57 E Main St

Lititz, Pa 17543

www.JasonsHomes.com

Do you know what a popcorn ceiling is? Love it? Hate it? Most people hate it. After all, ceiling popcorn is about the most useless (not to mention ugliest) decoration ever. Want to get rid of it? Well. Normally that involves scraping it off, or demolition. Tear it down. As effective as that tutorial is, some of you might not want to get that messy. Or if your house was built in the 1950’s, scraping off popcorn means dealing with potential health hazards like asbestos. Not fun or safe.

Do you know what a popcorn ceiling is? Love it? Hate it? Most people hate it. After all, ceiling popcorn is about the most useless (not to mention ugliest) decoration ever. Want to get rid of it? Well. Normally that involves scraping it off, or demolition. Tear it down. As effective as that tutorial is, some of you might not want to get that messy. Or if your house was built in the 1950’s, scraping off popcorn means dealing with potential health hazards like asbestos. Not fun or safe.

Well, I have some great news! Imgur user, makesomething, chose a different way to handle the ceiling popcorn in a room in his 1950 home. Here’s the thing, they didn’t even bother removing the popcorn at all!

Removing all those layers would be too much of a hassle.

They also bought 2 inch brand nails, which they used to nail some planks to the joists in the ceiling.

However, if you want to save money, you could always use wooden pallets!

Obligatory dog photo. She would walk in every once in a while to check on the progress.

This method would be awesome for old, cracked plaster ceilings too! Not exactly a DIY kind of person and need a professional to help you pull this off? Call me, I can connect you with a contractor!

Have questions? Do you want to buy or sell a property? Call me or text at 717-371-0557, I’ll be happy to help you! You can always email me at Jason@JasonsHomes.com or contact me at the office at 717-291-1041 as well!

Your Friend in Real Estate,

Jason Burkholder

Realtor, e-Pro

Associate Broker

Certified Marketing Specialist

Weichert, Realtors – Welcome Home

717-291-1041 office

717-371-0557 direct or text

PS – As always, I’d like you to be part of the conversation, so if you like what you read here please feel free to let me know, forward this post to your friends and subscribe!