Here is the headline from the AP Storythat ran yesterday “Senators agree to extend homebuyer tax credit”. Look spretty good, doesn’t it? Reading that, you would think we were in the clear, tax credits for everyone! Well, I hate to  rain on everyone’s parade, but we still have a long way to go.

rain on everyone’s parade, but we still have a long way to go.

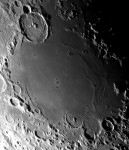

Think of this process like looking at the moon through a telescope, it’s there, you can see every detail, you almost feel like you can reach out and touch it……. yet it is still thousands of miles away.

detail, you almost feel like you can reach out and touch it……. yet it is still thousands of miles away.

According to a quick release from The National Association of Realtors today, the Senate is voting on an amendment to Extend Unemployment Insurance Benefits. In this bill, there is an amendment titled “Dodd-Lieberman-Isakson Amendment to Extend and Expand the $8,000 First Time Homebuyer Tax Credit”.

According to a quick release from The National Association of Realtors today, the Senate is voting on an amendment to Extend Unemployment Insurance Benefits. In this bill, there is an amendment titled “Dodd-Lieberman-Isakson Amendment to Extend and Expand the $8,000 First Time Homebuyer Tax Credit”.

Happy Monday Everyone! It’s time once again for thenewest Monday Fit Bit from Mickey Glick at Body and Soul Fitness Studio. This week Mickey, wants you toknow that back pain can be addressed through strength training:

STRENGTH TRAINING 5 TIMES MORE EFFECTIVE THAN AEROBICS AGAINST LOW BACK PAIN

I saw an article posted on Rismedia the other day (http://rismedia.com/2009-10-15/8000-tax-credits-hoops-frustrate-house-hunters/) that was picked up from the Orlando Sentinel. The reporter (Mary Shanklin) titled the article “$8,000 Tax Credit’s Hoops Frustrate House Hunters”.She wrote a nice article about the challenges some people are facing in today’s market, concise and well written. In reality, the challenges she outlinedhave nothing to do with the tax credit. Let me give you theexamples used,summarizedfrom the article:

I saw an article posted on Rismedia the other day (http://rismedia.com/2009-10-15/8000-tax-credits-hoops-frustrate-house-hunters/) that was picked up from the Orlando Sentinel. The reporter (Mary Shanklin) titled the article “$8,000 Tax Credit’s Hoops Frustrate House Hunters”.She wrote a nice article about the challenges some people are facing in today’s market, concise and well written. In reality, the challenges she outlinedhave nothing to do with the tax credit. Let me give you theexamples used,summarizedfrom the article:

T he 99 Cent effect, maybe you’ve heard of it, maybe not, but did you ever wonder why prices end in 99? Turns out there is a proven psychological effect (dating all the way back to 1800’s) with prices that end in 9. Researchers at the Rutgers School of Business found that prices ending in .99 communicate low price to consumers and consumers are then more likely to buy.

he 99 Cent effect, maybe you’ve heard of it, maybe not, but did you ever wonder why prices end in 99? Turns out there is a proven psychological effect (dating all the way back to 1800’s) with prices that end in 9. Researchers at the Rutgers School of Business found that prices ending in .99 communicate low price to consumers and consumers are then more likely to buy.

Time for another Tip from Matt Steger at WIN Home Inspections, any questions call Matt at ! Enjoy!

This week’s maintenance tip sends us outside to check your roof, gutters and downspouts, and the grounds around your home.

The House of representatives passed a bill 3590 on October 8, 2009 that:

“…. Amends the Internal Revenue Code to: (1) exempt members of the uniformed services, the Foreign Service, and employees of the intelligence community on official extended duty service from the recapture requirements of the first-time homebuyer tax credit; (2) extend the first-time homebuyer tax credit through November 30, 2010, for individuals serving on official extended duty service outside the United States for at least 90 days in 2009; (3) exclude from gross income payments to military personnel to compensate for declines in housing values due to a base closure or realignment; …..”

You can view the bill here in this link:

H.R. 3590: Service Members Home Ownership Tax Act of 2009

Short simple and to the point, eligible service members who served at least 90 days in 2009 have until the end of 2010 to claim the $8,000 First Time Home Buyer Tax Credit. While the House voted OVERWHELMINGLY in favor of it the bill still must pass the Senate and be signed into law, let’s hope the politicians get it right this time, our Veterans deserve this and more!

I’d like you to be part of the conversation here, so please, comment, forward The Pulse of Lancaster to your friends, subscribe and as always, if you have questions, need real estate advice or want to buy or sell a home, you can call or text me at 717-371-0557, email me at Jason@JasonsHomes.com or contact me at the office at 717-490-8999!

Your Friend in Real Estate,

Jason Burkholder

Search for Lancaster County Homes for sale by clicking here!

Want to see local real estate values and home prices? Go to www.RealEstateCrystalBall.com !

Ok, here we go, this is the first of many regular Monday columns on The Pulse of Lancaster from Mickey Glick, Owner of Body & Soul Fitness Studio. Mickey will be giving you tips and advice on how to do quick, simple workouts to keep you Healthy at Home. For more information or to find out how Mickey can help you, call her at 717-509-7777! Enjoy!

How many times did your parents say, “Pay attention to what you’re doing?” I don’t know about you, but my mom said that all the time. That’s also good advice to follow when you’re strength training too.

Over the years, there’ve been countless times I’ve seen people mindlessly going through their routine while they daydreamed, thought about work, chatted with people, etc. For maximum benefit, you need to focus on what you’re doing. Make sure you’re using a weight that’s challenging. Stop thinking about what you’ll have for dinner, what chores you need to do or office politics. Concentrate. It’s important to perform each exercise using proper form. Work through a full range of motion and squeeze the muscle you’re working.

Make the decision to stay focused during your exercise sessions. You’ll get a better workout and faster results.

I’d like you to be part of the conversation here, so please, comment, forward The Pulse of Lancaster to your friends, subscribe and as always, if you have questions, need real estate advice or want to buy or sell a home, you can call or text me at 717-371-0557, email me at Jason@JasonsHomes.com or contact me at the office at 717-490-8999!

Your Friend in Real Estate,

Jason Burkholder

Search for Lancaster County Homes for sale by clicking here!

Want to see local real estate values and home prices? Go to www.RealEstateCrystalBall.com !

This column is the first of many from my friend Matt Steger at WIN Home Inspection, when one of my clients need an inspection, Matt is the man I call. Matt’s Home Inspection Services are thorough, detailed and his reports are easy to read and understand. Call Matt at 717-361-9467 for all of your home inspection needs. Every Friday you can watch for Home Maintenance Advice from The Pulse of Lancaster right here, in the Inspector’s Corner! Enjoy!

Autumn is here again. The leaves will soon be changing, baseball playoffs are under way, hockey season has started, and you are probably spending a little less time outside. This series of tips should help you maintain your home and get it ready for winter.

1. One of the most important things you should do this month is having your home’s heating system serviced. Whether your home is heated with a furnace, heat pump, or boiler, now is the time to make be sure it is ready for the cold months. You don’t want to wake up some January morning only to find that your heating system no longer functions. Regular preventive maintenance is key to ensuring safe and reliable service from your heating system as well as helping to prevent expensive unforeseen repairs down the road.If your home has upper and lower return louvers, now is the time to open the bottom return louvers and close the top return louvers. Just remember that warm air rises and during the cooler months, you want warm air to stay in the room. If you have a forced air system (furnace or heat pump), also make sure to replace or clean your air filter. A dirty air filter can put extra stress on your system and prevent proper filtering of your home’s air. Most air filters should be changed monthly (woven fiberglass type) or every 90 days (paper element type). Should your system use a large media type of filter (often 4â€~7†thick and looking sort of like an accordion), this type of filter normally needs replacing every 12 months. Most heating contractors will change or clean the filter during their annual maintenance visit. Should your heating system vent into a chimney, make sure the metal exhaust pipe is fully sealed into the chimney. Furnace cement is used for this application. Should you have a heating system that is direct-vented (with PVC pipe, for example) make sure none of the exterior vents have vegetation blocking them.

If you have a programmable thermostat, you also want to change the settings to reflect the propertemperatures for heating season and adjusted times for standard time (when we change our clocks). If you don’t have a programmable thermostat, you may want to think about installing one to help lower energy bills. If you have a heat pump system with built-in auxiliary heat (sometimes called Backup heat or EMHeat), you will normally need a special heat pump programmable thermostat that has the backup heat capability.

If you have electric baseboard heaters, they often accumulate dust over the spring and summer and turning them on now, tends to cause a burning smell. You can use a vacuum cleaner’s hose attachment or a rag to clean off the dust so all you get is heat when you run these over the winter.

I’d like you to be part of the conversation here, so please, comment, forward The Pulse of Lancaster to your friends, subscribe and as always, if you have questions, need real estate advice or want to buy or sell a home, you can call or text me at 717-371-0557, email me atJason@JasonsHomes.com or contact me at the office at 717-490-8999!

Your Friend in Real Estate,

Jason Burkholder

Search for Lancaster County Homes for sale by clicking here!

Want to see local real estate values and home prices? Go towww.RealEstateCrystalBall.com !

A recent article by Ken Harney at the LA Times cited a study done by Experian (one of the 3 major credit reporting bureaus) that highlighted some very interesting information about foreclosures. Think foreclosures only happen to people with bad credit? Think again!

Traditional thinking indicates that foreclosures happen to people who are “down on their luck”, maybe they lost a job, maybe they got sick or maybe they were careless, overspent and are getting foreclosed on because they are in over their heads. There is typically a pattern that appears in their credit history, late payments, missed payments delinquencies on other debts. A growing trend over the last few years has been contrary to this pattern. People with great credit scores and no other “warning signs” or “life changing events” such as a job loss are being foreclosed on in record numbers.

The study done by Experian looked for answers to that question and using data from 24 million credit that they were able to review over time to look for patterns, they found some interesting trends. Here are some of the things they found:

Also, the study found that people with high credit scores at the time of loan application are 50% more likely to strategically default than people with poor credit scores.

So what does it all mean, who is doing this? Well, for starters, there are some people gaming the system. They bought to high, they speculated, they bled out their equity and now rather than make good on the debt they are just walking away, kinda like stealing. Then there are people who legitimately intended to make good on the debt, had wanted to build equity, own a home, live the dream. These people, as the survey indicates, are typically in markets where there is a significant amount of negative equity. They have no missed payments, no problems making payments, they just take a hard look at their situation, decide that they will never recover the loss in equity (buying a home for $400,000 and it being only sellable for $200,000 and yes, in California and Florida that really happened) and just walk away. They know their credit will be damaged and here is the problem with this whole scenario, why walking away is more attractive than sticking it out and making good on their debt: in 3 years, if they treat their credit reports right and rebuild those scores, they could get a brand new mortgage on another home.

There are many legal implications here that I won’t go into since I am not a lawyer, walking away does not always make the debt go away. Let’s not forget either the ethical problems associated with taking a mortgage, promising to pay it back and then just breaking your word and walking, there by making the rest of us pay for it in higher interest rates and bail outs, but let me ask you, is a strategic default right or is it wrong? If you were in this situation, what would you do?

I’d like you to be part of the conversation here, so please, comment, forward this to your friends, subscribe and as always, if you have questions, need real estate advice or want to buy or sell a home, you can call or text me at 717-371-0557, email me at Jason@JasonsHomes.com or contact me at the office at 717-490-8999!

Your Friend in Real Estate,

Jason Burkholder

Search for Lancaster County Homes for sale by clicking here!

Want to see local real estate values and home prices? Go to www.RealEstateCrystalBall.com !